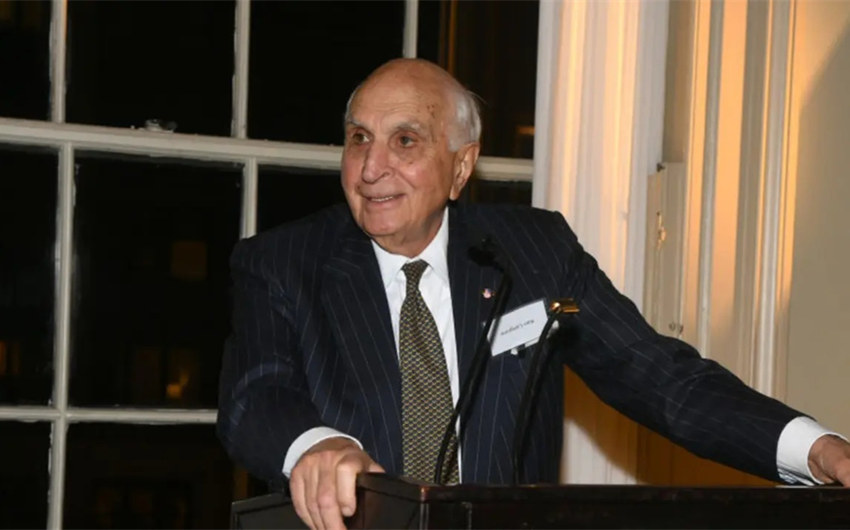

Kenneth Langone Net Worth: Home Depot Financier’s Billionaire Fortune and Income Sources

Kenneth Langone net worth is typically estimated in the $8 billion to $10 billion range, with many public trackers clustering around roughly $9 billion. There’s no single “official” number, but the structure behind the estimate is clear: most of his wealth is tied to equity stakes and long-term investing, not a salary paycheck.

Who Is Kenneth Langone?

Kenneth “Ken” Langone is an American businessman, investor, and philanthropist best known for helping arrange the financing that launched The Home Depot and for co-founding (and backing) major investment ventures over decades. He’s often described as a classic Wall Street connector—someone who built wealth by spotting opportunities early, structuring deals, and maintaining meaningful ownership positions rather than simply collecting fees.

Langone’s public profile also includes high-level board and finance work, along with widely reported philanthropic giving, especially to education and healthcare institutions. Even so, when you’re talking about his net worth, the story is overwhelmingly about ownership: the value of what he holds (and held) in major businesses.

Estimated Net Worth

Estimated net worth: about $9 billion, with a reasonable public estimate range of $8 billion to $10 billion.

You’ll see different figures depending on the source, mostly because the largest pieces of his wealth are not “fixed.” If a big portion of your fortune is tied to stocks, private equity holdings, and business stakes, your net worth can move significantly with market conditions, company performance, and how outsiders estimate private asset values.

The most grounded way to think about his wealth is not “how much cash does he have,” but “how much value does he control through equity and long-term investments.”

Net Worth Breakdown

Home Depot: the foundational wealth engine

The Home Depot connection is the headline for a reason. The company became one of the most valuable retailers in the world, and Langone’s early involvement helped put him in the wealth category where ownership appreciation does most of the heavy lifting.

Here’s why this matters for net worth: when you have an early, meaningful stake in a company that becomes a giant, you don’t need constant new income to get richer. The asset grows. If the stock rises over time, your fortune rises with it. That also means his net worth can swing year to year, because retail stocks can move meaningfully based on the economy, housing demand, interest rates, and consumer spending.

Even if you don’t know the exact size of his current stake today, Home Depot’s long-term growth explains why his wealth sits comfortably in the billionaire tier.

General Atlantic: long-term investing and private equity upside

Langone is also strongly linked to General Atlantic, the global growth equity firm. Growth equity wealth tends to be “quiet” because it’s often built in private markets before a company ever becomes a household name. But it can be enormous when the firm backs winners that later go public, get acquired, or mature into high-value private businesses.

From a net worth perspective, this category is powerful because it combines two wealth drivers:

- Ownership in the investment platform (the firm itself can be valuable).

- Exposure to portfolio winners that create large gains over time.

This is also one reason net worth estimates vary. Outsiders can easily value public stock holdings. They cannot easily value private equity interests, carried interest, and the worth of private positions without inside information.

Other investments and deal participation

Wealth at Langone’s level typically isn’t built from one company alone. High-level investors often accumulate a portfolio over decades—stakes in businesses, funds, and deals that compound over time. Some positions may be small compared to Home Depot, but a long history of investing can add meaningful “extra billions” when combined with market growth and smart timing.

Think of this part of the story as the stabilizer. When one asset slows down, another can surge. Diversification is one reason long-term billionaires tend to stay wealthy even when a single sector turns choppy.

Board roles and finance leadership: meaningful, but not the main pile

Langone has held prominent board roles and finance-related positions over the years. Board compensation can be substantial for the average professional, but it’s rarely the core driver for someone worth billions. At his level, board roles tend to matter more for influence, access, and deal flow than for the actual checks.

That said, board work can still add to wealth in two ways:

- It can include stock awards, which may appreciate.

- It can create early visibility into opportunities that later become investments.

So while board compensation isn’t what makes him a billionaire, board access can support the investing ecosystem that does.

Real estate and personal assets

Ultra-high-net-worth individuals often hold valuable real estate, but it usually plays a supporting role compared to business equity. Real estate can preserve wealth and provide appreciation, yet it typically doesn’t explain multi-billion net worth on its own.

In Langone’s case, property and lifestyle assets likely represent a meaningful number in absolute dollars, but still a smaller slice relative to the value created by major business ownership.

Philanthropy and what it says about the “real” number

Langone is well known for major philanthropy, including large gifts connected to education and healthcare. Philanthropy doesn’t directly increase net worth, of course, but it does reveal something important: he has had the liquidity and asset strength to give at a scale that most wealthy people simply can’t sustain.

For net worth estimation, that’s a clue that the billionaire range is plausible, even if no one can produce a precise, audited balance sheet for public consumption.

Featured Image Source: https://marketrealist.com/net-worth/ken-langone-net-worth/