Paris Hilton’s Husband Net Worth: Carter Reum’s Estimated Wealth and Breakdown Today

Paris Hilton’s husband net worth is most often estimated in the $20 million to $40 million range. You won’t find an official, verified figure, because private investments and privately held business interests aren’t fully disclosed to the public. But the estimate makes sense when you look at how Carter Reum built his career: finance, entrepreneurship, investing, and brand-building.

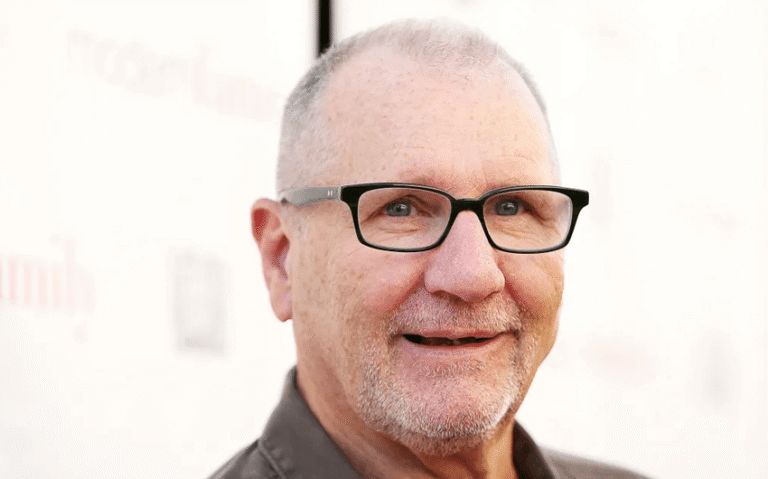

Who Is Paris Hilton’s Husband?

Paris Hilton’s husband is Carter Reum, an entrepreneur, author, and investor. He’s best known for co-founding a spirits brand and later building his profile as a venture capitalist and startup investor. While Paris Hilton is a globally famous celebrity and businesswoman, Reum’s reputation comes from the business side—deals, ownership, and long-term investment strategy rather than entertainment paychecks.

He’s also the kind of figure whose wealth can look “quiet” from the outside. You might not see constant headlines about his income, but in the investing world, money often grows through equity stakes and exits over time, not through highly public salaries.

Estimated Net Worth

A reasonable estimate for Carter Reum’s net worth is $20 million to $40 million. Some online sources claim higher numbers, but those often rely on vague assumptions or lump him into broader “celebrity household wealth.” The more grounded way to treat his net worth is as a range based on likely outcomes from his known business lanes: a consumer brand built for scale, investing activity, and the kind of portfolio value that rises and falls depending on market cycles.

It’s also worth separating two ideas that often get mixed together:

- Income is what he earns in a year from salary, dividends, or profit distributions.

- Net worth is the estimated value of everything he owns (business stakes, investments, property) minus what he owes.

For investors and entrepreneurs, net worth is often driven by ownership value—meaning the number can shift without them “earning” more in a traditional sense.

Net Worth Breakdown

1) Entrepreneurship: building a consumer brand

One of the clearest pillars behind Reum’s wealth is entrepreneurship in the consumer-products space. Co-founding a brand can create wealth in two main ways. First, the business can generate ongoing profits if sales are strong and margins are healthy. Second, and often more importantly, a brand can become an asset that gains value over time and eventually leads to a major liquidity event (like a buyout, acquisition, or strategic partnership).

Consumer brands are particularly powerful when they hit the right combination of distribution and marketing. If a product becomes widely stocked and has strong repeat purchase behavior, the valuation can rise quickly, because buyers aren’t purchasing “one-time hype”—they’re buying a revenue engine.

2) Venture capital and startup investing

Venture investing is another key piece of the puzzle. When someone invests early in startups, the financial outcome typically follows a “long tail” pattern. Many investments don’t pay out, some return modestly, and a small number can deliver outsized gains. This is why venture wealth is hard to estimate from the outside: you don’t know which investments are winners, how large the stakes are, or how close they are to an exit.

In net worth terms, venture activity can matter a lot even when it looks invisible. A portfolio can sit quietly for years, then jump in value when one company raises at a higher valuation, goes public, or gets acquired. That’s also why public estimates of Reum’s net worth can vary widely—outsiders are essentially guessing at private portfolio value.

3) Finance background and deal-making leverage

Before the public knew his name, Reum built his foundation through finance. A finance career can provide two important advantages for later wealth-building: access to networks and comfort with complex deal structures. Those two factors can influence net worth more than a high salary ever could. If you understand how to structure ownership, negotiate equity, and evaluate risk, you’re better positioned to build long-term wealth through assets rather than paychecks.

For many entrepreneurs, this “deal literacy” is what separates a good business from a fortune. The same revenue can produce very different personal outcomes depending on ownership percentages, investor terms, and exit timing.

4) Books, speaking, and “public-facing” business income

Reum has also earned money through author and speaker-style channels. This category usually isn’t the main driver of a multi-million net worth, but it can provide consistent income and brand power—especially if it leads to paid speaking events, partnerships, or consulting opportunities.

Think of this as “reputation monetization.” When someone is seen as an authority in business or investing, it can create a steady pipeline of paid opportunities that support wealth preservation and investing capacity.

5) Real estate and asset growth

High earners and investors often place wealth into real estate, either as a lifestyle choice or as a long-term store of value. Property can strengthen net worth because it can appreciate over time, and it can also help stabilize wealth when markets are volatile.

This is another reason net worth estimates differ. Real estate values change with the market, and many details of personal property holdings are private. Two estimates can disagree simply because they assume different property valuations or debt levels.

6) What net worth estimates usually miss: costs, taxes, and liquidity

Even when someone is wealthy on paper, real life reduces the “spendable” portion of that wealth. Taxes take a large share of cash income and capital gains. Investment management comes with fees. Businesses have operating costs. And private assets aren’t always liquid—you can’t necessarily turn ownership stakes into cash instantly without selling or refinancing.

That’s why the best way to understand Paris Hilton’s husband net worth is as a portfolio-style fortune, not a celebrity salary story. It’s wealth built through ownership and investment value, which can rise over time but also fluctuates with markets and deal timing.