Earl Blumenauer Net Worth Estimate, Who He Is, and Wealth Breakdown

Earl Blumenauer net worth is best discussed as an estimate based on public financial disclosures, not as a single confirmed number. Because members of Congress report assets and liabilities in value ranges (not exact figures), outside estimates can differ depending on methodology. Still, the broad picture is clear: his wealth has largely been tied to long-term investments and real estate, not congressional salary.

Who Is Earl Blumenauer?

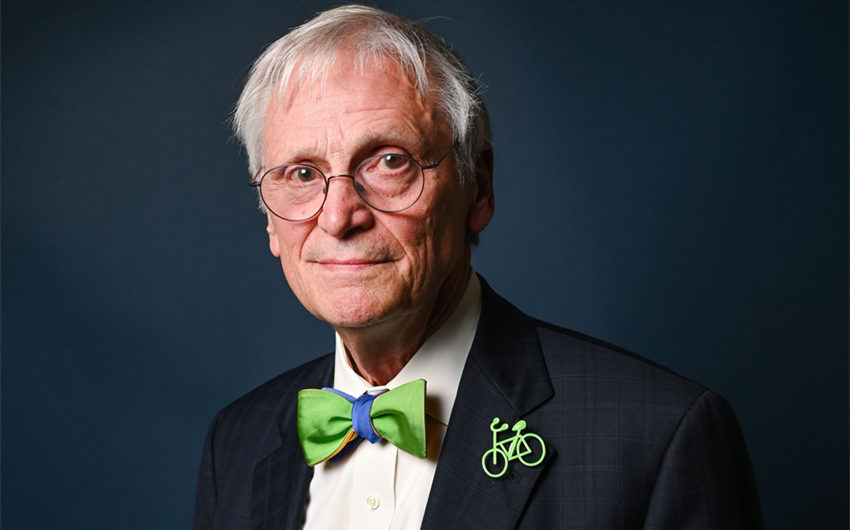

Earl Blumenauer is a longtime Oregon public official who served as a U.S. Representative for Portland-area Oregon’s 3rd congressional district from 1996 until leaving office on January 3, 2025. He became nationally recognizable for his signature bow ties and bicycle pin, as well as his policy focus on transportation, land use, climate issues, and cannabis reform.

Before Congress, he held several local government roles in Oregon, including serving on the Portland City Council. After his congressional service ended, he moved into a post-government role connected to Portland State University, continuing public-policy and civic work outside elected office.

Estimated Net Worth

There is no single “official” net worth number for Earl Blumenauer. However, estimates derived from his disclosure-based asset ranges commonly place him in the multi-million-dollar category. A practical, conservative range is roughly $5 million to $15 million, with some disclosure-based trackers clustering toward the low-to-mid eight figures depending on how they value holdings and whether they model the top end or midpoint of disclosure ranges.

The reason the range is wide is that congressional disclosures work in brackets. If a disclosure lists an asset value as “$1,000,001–$5,000,000,” one estimator might use the midpoint, another might use the minimum, and another might use the maximum. Multiply that across multiple assets, and you can end up with noticeably different totals even when everyone is reading the same public forms.

Net Worth Breakdown

Real estate as a core wealth anchor

For many long-serving public officials who build wealth over decades, real estate is often the most visible and stable piece of the balance sheet. Property can contribute to net worth in two ways at once: it provides a place to live and it can appreciate significantly over time, especially in markets like Portland and the Washington, D.C. area.

Because public disclosures do not always provide precise addresses or exact market values, outside estimates typically treat real estate as a range-based asset. That’s one reason his net worth estimates can look “high” even without a corporate executive salary. A home purchased years earlier can become a multi-million-dollar asset simply due to long-term market appreciation, even if the owner’s annual income is relatively ordinary by private-sector standards.

Investment portfolio holdings and long-term compounding

The second major pillar is investments. Disclosure-based trackers often show a diversified set of holdings rather than a single concentrated bet. In net worth terms, diversification matters because it supports steady compounding: if you consistently invest over many years, you can build sizable wealth without a single dramatic payday.

Another detail that affects estimates is that holdings can be reported under a spouse’s name or in retirement accounts. Retirement accounts can hold mutual funds, stocks, and bonds that are difficult to “see” in a simple headline number, yet they can represent a meaningful portion of net worth when someone has saved consistently over a long career.

It’s also worth noting that some transactions reported publicly can be things like dividend reinvestments or routine portfolio maintenance. Those do not necessarily indicate aggressive trading for profit. They often reflect standard investing behavior, which supports a gradual wealth-building profile rather than a flashy one.

Congressional salary: steady income, but not the main driver

Congressional pay is meaningful in everyday terms, but it generally does not create multi-millionaire wealth on its own unless combined with investing, property appreciation, and long service. The bigger financial impact of a stable government salary is that it can support consistent saving and investing for many years.

So when you see a multi-million estimate for a long-serving member of Congress, the most realistic explanation is usually not “the salary made them rich.” It’s “the salary supported a long period of saving, investing, and asset ownership,” especially if the person also had earlier career earnings and built wealth through market appreciation.

Post-congress income and advisory work

After leaving office, many former members of Congress earn income through speaking, advising, teaching, or institutional roles. In Blumenauer’s case, his post-congress connection with a major public university suggests a continued professional income stream, even if it’s not the kind of compensation that rivals private-sector executive pay.

This category typically matters more for stability than for massive net worth growth. It can help preserve wealth, support ongoing expenses, and reduce the need to draw down investments, which is often just as important as generating new income.

Liabilities and why they change the math

Net worth is assets minus liabilities. That means mortgages, loans, and any other obligations can meaningfully change the estimate. A person can own valuable real estate while also carrying significant financing against it, and disclosure-based estimators may handle that differently depending on how liabilities are reported and categorized.

This is one reason two estimates can disagree even when the asset list looks similar. If one model assumes a large mortgage balance and another assumes minimal debt, the bottom-line net worth can shift by millions.

Featured Image Source: https://www.wweek.com/news/2023/11/01/exit-interview-earl-blumenauer/