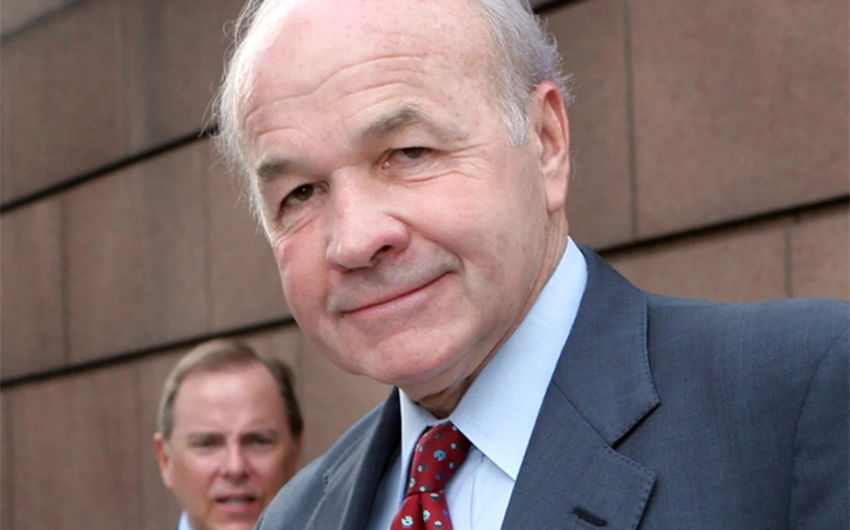

Ken Lay Net Worth: Who He Was, Estimated Wealth, and What Happened to It

Ken Lay’s net worth is one of those figures that depends heavily on when you’re measuring it. At Enron’s height, he was widely described as having a fortune in the hundreds of millions. After Enron collapsed, his wealth picture flipped dramatically—so much so that he later claimed his net worth had turned negative. The simplest way to understand Ken Lay’s money is to view it in two phases: peak Enron-era paper wealth, followed by post-collapse losses, legal exposure, and shrinking liquidity.

Who Was Ken Lay?

Kenneth Lee “Ken” Lay was an American energy executive and the founder of Enron. He served as the company’s chairman and CEO during the period when Enron grew from an energy pipeline business into a financialized energy-trading powerhouse. For years, Enron was treated as a corporate success story—innovative, fast-growing, and politically connected—until its accounting scandal unraveled the company in 2001.

Lay became one of the most recognizable faces of the Enron era, representing both the corporate ambition of the 1990s and, later, the fallout of one of the most infamous business collapses in modern American history. He was convicted on multiple fraud-related counts in 2006 but died before sentencing.

Estimated Net Worth

Estimated peak net worth: commonly described as roughly $400 million during Enron’s strongest years, though any exact figure should be treated as an estimate rather than a verified accounting.

Estimated net worth after Enron’s collapse: far lower, with Lay himself claiming around the time of trial that his net worth had become negative (often cited near -$250,000), largely because his wealth was concentrated in Enron stock and because the collapse triggered massive legal and financial pressure.

Those two numbers aren’t contradictory—they reflect two realities. During the boom, Lay’s net worth was heavily “paper wealth,” inflated by stock value. After the bust, the same concentration became a trap: once Enron shares cratered, the asset that made him rich stopped functioning as wealth.

Net Worth Breakdown

Enron stock: the biggest driver, and the biggest vulnerability

The core of Ken Lay’s wealth was Enron equity. In the late 1990s and early 2000s, Enron’s share price and public reputation helped turn senior executives into extremely wealthy people on paper. For Lay, stock wasn’t just an investment; it was the foundation of his personal financial identity.

But stock-heavy wealth works differently than cash. It can evaporate quickly. Once confidence in Enron collapsed and the company’s true financial condition became public, the share price fell steeply. If most of your net worth is tied to one company’s shares—and that company implodes—your fortune can shrink faster than you can react, especially when trading restrictions, investigations, and public scrutiny intensify.

Cash-outs and share sales: real money pulled forward

Even when most wealth is stock-based, executives often convert some of it into real cash through share sales. Reporting around Enron’s final months has long emphasized that top executives sold large amounts of stock as the company headed toward crisis. That matters for net worth because it can create a gap between “paper value” and “cash you actually banked.”

In Ken Lay’s case, the public record shows that he did sell significant shares before Enron’s bankruptcy. Those sales likely formed a meaningful portion of any liquid wealth he had during the transition from boom to bust. However, liquid cash-outs don’t automatically equal lasting net worth if the money is later consumed by legal defense costs, settlements, taxes, debt obligations, or asset freezes.

Executive compensation: salary, bonus, and stock-based pay

Ken Lay was also paid as a top corporate executive, including a high base salary and additional compensation structures common to CEOs—bonuses, stock awards, and other benefits. In big corporate years, executive pay can look enormous in total value, but it often arrives in a mix of cash and stock incentives.

What that means in practical terms is that his headline compensation could be very large while his day-to-day liquidity was still tied to stock. When the stock collapses, the “total compensation” story doesn’t translate into secure, spendable wealth unless a significant portion was taken in cash and preserved.

Assets and liabilities: homes, loans, and personal balance-sheet complexity

High-net-worth executives often have complex personal finances—multiple homes, mortgages, lines of credit, and guarantees. Those liabilities matter a lot when wealth is shrinking. A billionaire-style lifestyle can be sustained easily when stock is soaring, but once the equity value collapses, fixed obligations can become a heavy drag on net worth.

This is one reason people underestimate how quickly a fortune can unravel. A person can still “look rich” publicly while their balance sheet is deteriorating behind the scenes due to debt, obligations, and legal pressures.

Legal costs and financial exposure after Enron’s collapse

The post-Enron period introduced a massive wealth drain that most ordinary net worth conversations ignore: legal exposure. Corporate scandal litigation can be financially crushing, especially when multiple cases, investigations, and defense efforts overlap.

Even when you have assets, you may not have easy access to them if they’re tied up in disputes or if courts and counterparties pursue claims. Legal defense can cost millions, and the wider fallout can create additional costs that are hard to quantify from the outside—expert witnesses, accountants, compliance specialists, and prolonged litigation stress.

This is the “silent net worth killer” that helps explain why someone who once appeared to have hundreds of millions could later claim a negative net worth. It’s not only the collapse of the main asset; it’s the years-long financial storm that follows.

Featured Image Source: https://www.nbcnews.com/id/wbna13715925